There are three ways to look at the term Application Performance Management (APM) – 1) management concept; 2) technology class; 3) positioning approach. After closely covering this market for over ten years, a quick glance at this year’s research shows – APM is not in good shape in any of these areas.

Over the last decade, APM experienced impressive growth which, at one point, resulted in close to 100 vendors using it in their positioning and end-users listing APM as the key area of their IT performance management effort. That is no longer the case. DEJ’s recent research shows that, for the first time in over a decade, APM and its core capabilities are not even one of the top three on the list of IT performance monitoring solutions that organizations are looking to invest in. There are three major reasons for that:

1 – New buyer requirements. There were many reasons for the rapid growth of APM markets, but maybe the most important one is that for the first time it allowed user organizations to: a) gain visibility into application transaction, which created a common language across IT silos; b) put end-user and business value ahead of infrastructure monitoring; c) support new approaches for designing and delivering IT services and measuring success. Each of these areas are still very important to end-users, they are just no longer enough to fuel growth of the APM market at the same rate. Changes in IT environments, innovation in enterprise technology markets and transformation of IT’s role in digital enterprises is cause for organizations to look beyond the value proposition of APM when thinking about managing IT performance.

2 – Maturity and adjacent markets. APM has been one of the most overused terms in the IT management and a market where vendor messaging created a lot of confusion and made it difficult for organizations to do a real apples-to-apples comparison when making purchasing decisions. The market has matured enough that the term APM is now used predominantly by vendors that provide code-level visibility. Vendors with different approaches for APM, such as network or infrastructure based solutions and user experience monitoring (EUM) specialists, created new adjacent markets and moved away from APM in their positioning.

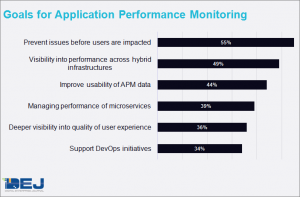

3 – Monitoring tools and data overload. Organizations are growing increasingly frustrated by the lack of correlation between data collected from their monitoring tools and the ability to solve major performance issues. The research shows that organizations are 44% more likely to report getting the most out of performance data, rather than collecting more data, as their goals for the next 12 months.

So does that mean that the further decline of APM is inevitable? The short answer is: it depends. The APM market, the way it is consisted now, is not very likely to bounce back unless vendors make changes in their offerings and positioning to take advantage of six key areas that could be driving new growth of APM.

Managing dynamic environments. 51% of organizations reported that their IT performance monitoring tools are not as effective when deployed in dynamic and hybrid environments. This is becoming especially true in APM as emergence of microservices and further growth of hybrid cloud environments and is driving the need for new APM capabilities and new approaches for monitoring application performance.

Over the last 3-4 years, three vendors – AppDynamics, Dynatrace and New Relic – established themselves as leaders in the APM market. An interesting fact is that these companies didn’t even exist when the term APM started picking up steam (parts of Dynatrace did, but not its core APM technology). One of the reasons these vendors experienced this type of success is that their solutions were built for, at that time, modern application architectures. Now when application architectures are changing again, opportunities arise for a new wave of innovative solutions to enter the market with a new approach and to challenge the leaders. This trend is already starting with vendors like Instana who already launched APM solution for dynamic application environments.

Analytics and data management. This concept is creating opportunities for growth and differentiation in two major areas: 1) performance analytics; 2) business use of APM data. DEJ’s research shows that advanced analytics capabilities and more sophisticated IT Operations Analytics (ITOA) concepts, such as machine learning, are having a major impact on the effectiveness of IT performance monitoring solutions in general and they are especially needed for managing application performance. Some vendors are already making strides in this area, but there is still a lot of room for improvement and innovation. Additionally, organizations are increasingly understanding that data collected by APM tools can be used as a source of information in many areas of their business, such as customer management, marketing, business forecasting and even in the areas of HR and Finance.

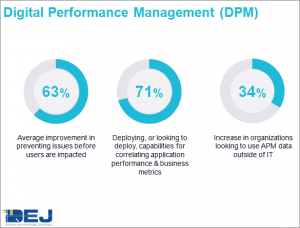

Digital Performance Management (DPM). The concept of tying application performance and the quality of user experience into business metrics is not new in the APM market, but trends in digital economy and new capabilities offered are creating major opportunities for vendors focused on Web performance monitoring and testing. DPM is the next step in the evolution of user experience monitoring, enabled by new business-centric metrics, a proactive management approach and strong analytics capabilities around operational and business performance.

API performance. DEJ’s research shows that having an API strategy as one of the key attributes of digital transformation leaders. Also, 46% of organizations listed API performance as one of the key focus areas for their IT monitoring efforts. Issues with API performance often go unnoticed as they do not necessarily visibly impact the quality of user experience, but they can have a significant business impact. Enhancing capabilities for detecting and preventing these types of issues could create new opportunities for APM vendors.

Automation. This is one of the key growth areas for IT performance monitoring and there are multiple opportunities for APM solutions to increase value delivered by applying more automation capabilities to their offerings. This is especially true in areas such as discovery mapping, data analysis, alerting and problem resolution.

Digital transformation enablement. With many organizations looking to reduce technology spend allocated on maintaining and running their existing IT services so they can free up resources for transformation and growth, APM solution can play an important role in helping these organizations become digital enterprises. However, opportunities that digital transformation brings for APM do not end there. More than 40% of organizations in DEJ’s research reported that APM can help with each of the key goals of digital transformation, such as making IT more strategic, creating new revenue streams, improving agility and customer engagement and experience.

Summary

Even though the term APM is not as hot as it once was, that doesn’t mean that having full visibility into different aspects of application performance is becoming less important for user organizations. For the most part, APM delivered on its promise and made a major difference in how organizations are managing the health of their IT services. The core value proposition of this approach is still very relevant, but APM-like technologies taking the center stage of IT management again will require new capabilities, positioning and areas where they can deliver value.