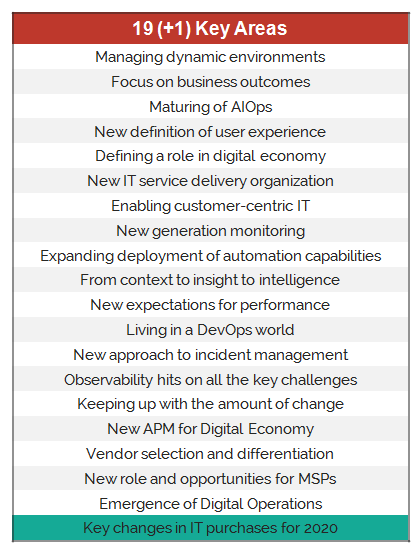

DEJ just published a new report titled “Top 20 Vendors for Managing IT Performance in 2020“. Prior to publishing this report, DEJ surveyed more than 3,500 user organizations and the findings from that research were summarized in our recent study “19 Key Areas Shaping IT Performance Markets in 2020“. One of the key findings of this research is that organizations are much more likely to evaluate vendors based on their effectiveness in helping them achieve their specific goals as compared to completeness of vendor solutions (58% vs. 35%).

DEJ used these 19 key areas as evaluation categories and evaluated hundreds of IT performance management vendors based on their effectiveness in solving top challenges for user organizations and meeting their fast-changing requirements. Most of the top 20 vendors included in the report are using different approaches and underlining technologies, but each of them have shown high levels of effectiveness in the key areas identified by DEJ’s survey research.

Key takeaways

1 – Enabling innovation and Technology-as-a-Competitive-Advantage (TaCA). DEJ’s recent study, “The Roadmap to Becoming a Top Performing Organization in Managing IT Operations” revealed that organizations are losing, on average, $2,129,000 per month, due to performance related slowdowns in application release times. Additionally, DEJ’s 2020 study on IT Transformation shows a 2.1 times increase in number of organizations using technology to differentiate from competitors since 2017. This report reveals that many of the top 20 vendors built strong capabilities for addressing this area from different perspectives.

Datadog’s Leader ranking in “Alignment with new selection criteria” comes from the company’s strong capabilities for transformation and modernization enablement. Additionally, vendors such as PagerDuty, Catchpoint, Humio, Gremlin and Lightstep received Leader ranking in the “Balance between speed of innovation and performance” due to their ability to reduce the amount of unplanned work for Developers and Engineers. Other vendors that ranked as Leaders in this category are meeting some top requirements of user organizations, such as context-based automation for shipping software faster (Dynatrace), visibility into the impact of new releases on performance (AppDynamics) and actionable data for improving code (New Relic).

Additionally, vendors such as ServiceNow, Instana, New Relic and PagerDuty were ranked as Leaders in the “Role in digital economy” area due to their strong capabilities for reducing the risk of deploying new transformational technologies.

2 – The triumph of vendors that go beyond technology buckets. The research shows that 39% of technology purchases in 2019 included solutions that don’t squarely fit in any defined category and a good portion of companies included in the report match that description (or they cut across multiple categories). Companies such as Anodot and PagerDuty provide a unique combination of capabilities that position them as leaders in some of the key areas such as “Focus on business outcomes” and “Enabling customer centric IT”. This proves again that the true value of vendors offerings can only be measured by their effectiveness in addressing key user requirements, not the number of boxes that their offerings check.

3 – The value of visibility into user experience. DEJ’s research shows two major trends: 1) a new definition of the quality of user experience (metrics, capabilities, etc.) and requirements for monitoring, and; 2) the strategic importance of solutions that can meet these new requirements. Aternity and Nexthink were not only ranked as Leaders in the “New definition of user experience” category, but also in highly strategic categories such as “Role in digital economy”, ” Keeping up with the amount of change” (Aternity) and “Focus on business outcomes”, and ” From context to insight to intelligence” (Nexthink).

Also, Catchpoint’s unique set of monitoring capabilities positioned the company as Leader in areas such as ” Balance between speed of innovation and performance” and “Enabling DigitalOps”.

4 – From emerging vendors to Leaders. DEJ’s research shows that 32% of organizations are evaluating or deploying solutions from vendors that they were not aware of 12 months ago. This shows the speed of changes in requirements for managing IT performance and the fact that vendors such as Gremlin, Lightstep, Humio and Instana have become leaders in addressing top challenges speaks to that fact. These solutions are built for problems of today, which gives them a clear advantage in understanding the users pain points and the best ways to address them.

Gremlin’s Chaos Engineering approach positioned the company as a Leader in areas such as “Enabling new IT service organization” and “Role in digital economy”. For example, improving agility and enabling organizations to be adaptive to change ranked high on the list of user requirements (63% and 53% of organizations, respectively). Humio’s evaluation showed that the company’s value to customers goes beyond its unique approach to log management and Humio’s capabilities for preventing performance issues and high scalability positioned the company as a leader in strategic areas such as “From context to insight to intelligence” and “Managing dynamic environments”.

The research shows that 38% of organizations are looking to improve their APM capabilities over the next 12 months, while reporting a new set of requirements for APM solutions. This positioned Instana and Lightstep, not only as Leaders in the “New APM for digital economy” area, but also in a number of other areas. Instana’s strong capabilities for a service-centric view into dynamic environments positioned the company as a Leader in the “New generation monitoring” area, while the ability to automatically discover service elements helped Instana’s highest ranking in “Keeping up with the amount of change”. On the other hand, Lightstep’s short time to value positioned the company as a leader in the “Alignment with new selection criteria” while strong capabilities for reducing time spent on identifying a root cause contributed to its highest rank in the “Observability” area.

5 – Context based automation and AIOps touching on all of the key areas. The value of AIOps solutions is typically perceived in more tactical areas, such as reducing alert noise. However, DEJ’s recent AIOps research shows that the reason organizations are deploying these types of solutions, and context-based automation in general, is to create actionable insights from IT data. That is also reflected in this research, as vendors that are providing these types of capabilities were ranked as Leaders in many strategic areas, such as “Role in digital economy” (BigPanda), “Focus on business outcomes” (CloudFabrix), “Enabling customer centric IT” (ScienceLogic) and ” Managing dynamic environments” (Micro Focus). Additionally, DEJ’s research shows that 58% of organizations are deploying these solutions to ship better software faster and Moogsoft was ranked as Leader in supporting DevOps and SRE teams in areas such as “Observability” and “Enabling new IT service organization”.

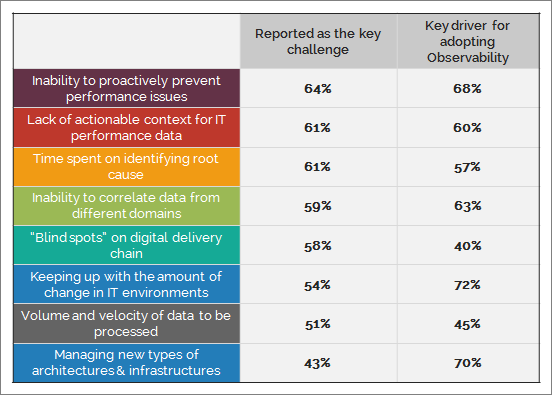

6 – The promise of Observability. DEJ’s research shows a 3.2x average increase in complexity of IT systems over the last 24 months. The research also shows strong alignment between top challenges of managing IT performance and drivers for adopting Observability. Technology vendors that were ranked as leaders in this area are showing strengths in different domains but, more importantly, their Observability capabilities translate to their leadership in some key strategic areas. For example, Moogsoft provides strong capabilities for providing actionable context for IT performance data which also contributed to their rank in the “New approach for incident management” area. Vendors such as Dynatrace, Splunk, Instana, Lightstep, CloudFabrix and New Relic also ranked as leaders in this area, but many of them are taking significantly different approaches to Observability.

DEJ’s upcoming research will dive into the Observability vendor landscape in more depth and it is important to highlight that Observability is not a technology market, but a concept and outcome that can be supported by using a variety of solutions that are based on different approaches and underlining technologies.

7 – Business-centric approach. The research shows that the impact on business outcomes is the #1 criteria for selecting It performance management solutions. This requires a new set of capabilities that contributed to the Leader status of several vendors. These capabilities are – correlation between technology value and business outcomes (Splunk, PagerDuty, Nexthink), understanding the value of using technology to create competitive advantage (Dynatrace, Micro Focus, ServiceNow) and measuring the impact of IT performance on business goals (Anodot, AppDynamics and ScienceLogic).

Summary

Vendors included in this report are best aligned to address the key user requirements. However, it should be noted that there is no “silver bullet” for addressing challenges of managing IT performance, as none of these vendors are providing all of the capabilities that are needed for addressing user requirements. User organizations should use this report to find the right mix of solutions that are the best fit for addressing their specific needs.